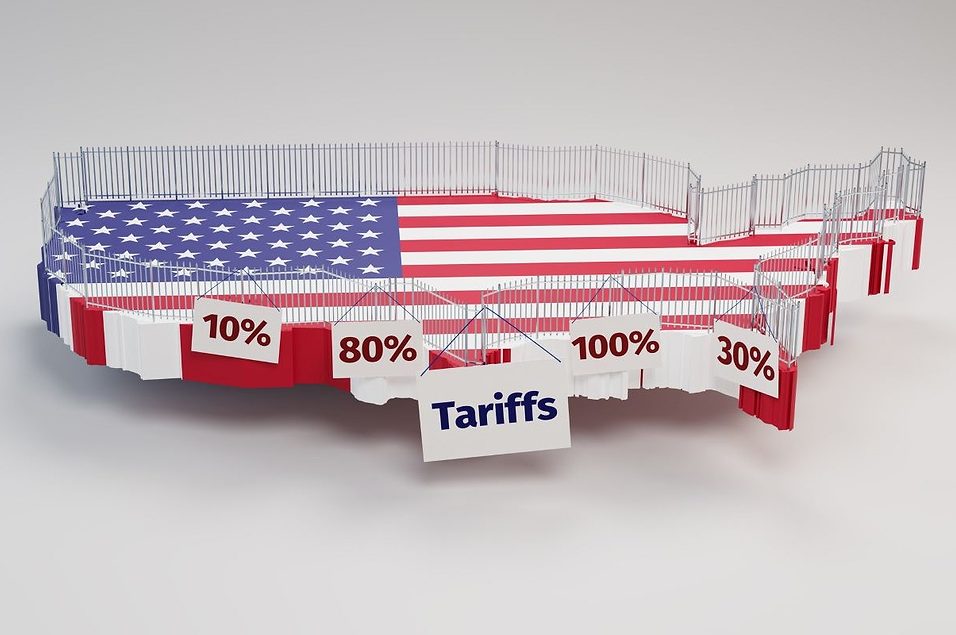

In 2025, the public conversation around tariffs was focused on disruption. Goods and components were no longer available from familiar overseas sources, prices spiked, and orders were suddenly cancelled. The angst was understandable, but the story was incomplete.

In 2026, the tariffs are propelling a structural reset in U.S. manufacturing that’s been overdue for decades. And the positive news is coming from many directions.

For manufacturers, distributors and import-dependent businesses, the tariff environment of 2025 has led to the clearest runway for U.S. reindustrialization in decades. The long-term effects are already visible, and are far more constructive than the headlines suggest.

The immediate impact of the 2025 tariffs forced companies to reorient supply chains established over 20 to 30 years. Pricing was unpredictable. Importers struggled to quote products months in advance of receipt as the cost of goods and delivery swung wildly. Distributors had to rethink their models entirely.

The uncertainty affected everyone. When projects are quoted a year ahead of delivery, tariff changes that land after contracts are signed create real complexity. Beyond the challenge to complete of projects already in motion, many U.S. manufacturers were frozen in place.

But in 2026, something critical has changed: Predictability has returned.

Most major trade positions are now set. Emergency measures are giving way to established mechanisms such as new reporting around Section 232 of the Federal Trade Expansion Act, the 1962 law that grants presidential authority to adjust tariffs to protect national security. This reporting brings deeper transparency and accuracy about all sourcing aspects of imported goods (such as steel and aluminum) for consistent pricing, and better protection against sudden shifts that could negatively impact U.S. industries.

Companies finally know the rules of the game, and can make sourcing decisions accordingly, which matters much more than low tariffs ever did.

For the past two to three years, capital expenditure in manufacturing has been suppressed by high interest rates and uncertainty. This is changing rapidly. We’re seeing a giant surge in engineering demand, which is the earliest indicator of expansion. Engineering precedes construction, automation installs and equipment purchases. When engineering pipelines fill up, it means companies are preparing to build.

Across sectors — from consumer goods to aerospace to raw materials — manufacturers are asking the question: What would it take to produce more of our products domestically?

The answer, increasingly, is automation.

Manufacturing didn’t leave the U.S. as a highly automated process. It left as largely manual work, and has stayed that way overseas. Now, as production returns, companies understand they cannot recreate the old factory model.

The U.S. doesn’t have the labor base to double manufacturing headcount. The only viable path forward is highly automated production through robotics, artificial intelligence-driven quality control, and digitally managed operations.

This shift is creating a virtuous cycle: Workers are upskilled into technician and systems-management roles. Productivity rises without proportional labor growth. And domestic manufacturing becomes cost-competitive again.

Which industries benefit most?

- Semiconductors. Massive investments in clean-room capacity and domestic silicon production are reshaping the supply base for AI, automotive and advanced manufacturing.

- Steel and aluminum. For the first time in decades, new blast furnace and electric arc furnace capacity is being announced in the U.S., alongside innovation to reduce carbon intensity.

- Electric vehicles and hybrids. With subsidies gone, the market is correcting toward advanced hybrids that better match consumer demand, while companies with clean-sheet EV designs continue to emerge and dominate.

- Solar systems (not panels). While panels remain offshore, batteries, inverters, power electronics, wiring and installation are expanding rapidly in the U.S.

Nearshoring is becoming strategic. Tariffs have accelerated regional supply chains. The United States-Mexico-Canada Agreement (USMCA) remains viable for many categories, while countries with existing trade agreements are becoming preferred partners. In short, nearshoring is no longer a political question, but is now about the necessity and competitive advantage of resilience and lead-time control.

While 2025 was disruptive, 2026 will be decisive. The tariffs didn’t fix U.S. manufacturing, but they have forced clarity on the manufacturing process. The solutions that replace fragile global supply chains will be more automated, more regional and more resilient.

From a systems perspective, this is not a setback. It’s a system rebuild.

Matthew Chang is founder and principal engineer with Chang Robotics.