A new report by the U.S. Geological Survey found that the country was 100% import reliant on foreign imports of minerals in 2025. Mining.com reported that the growing reliance on foreign imports of minerals over the past year highlights the increased urgency to bolster U.S. domestic supply chains.

In its annual mineral commodities summary published on February 6, the USGS concluded that the U.S. was reliant on imports for 16 out of the 90 non-fuel commodities that it tracked. In addition, the U.S. relied on imports for more than one-half of its apparent consumption for 54 of the minerals, the report showed.

By contrast, the 2024 data showed 100% import reliance for 15 commodities and more than one-half import reliant for 46 minerals, the USGS said.

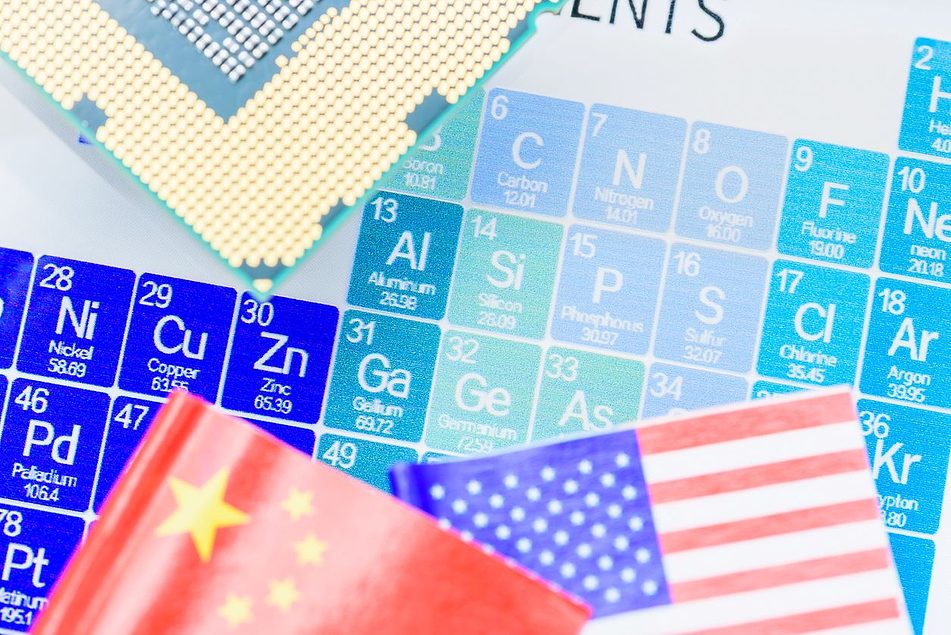

The U.S. is totally reliant on its imports of arsenic (all forms), asbestos, cesium, fluorspar, gallium, graphite (natural), indium, manganese, mica (natural), niobium (columbium), rubidium, scandium, strontium, tantalum, titanium (sponge metal) and yttrium. Most of these are on the USGS critical minerals list, with asbestos, mica and strontium being the only absentees.

An additional 20 critical minerals had a net import reliance of greater than 50%, down from 28 in 2024, USGS noted.

China is a key supply source for the U.S., accounting for nearly half of its arsenic and graphite imports, 55% of its antimony, and 70% of rare earths.

More: Podcast | Can the U.S. Ever Stop Relying on China for Critical Minerals?

“This report underscores just how hard it is to put a dent in China’s decades-long strategy to dominate the world’s minerals markets,” said Rich Nolan, president and CEO of the National Mining Association (NMA), in a press release.

Another leading source of critical minerals is Canada, which supplies the aluminum, gallium, potash and zinc to the U.S. For copper and silver, which were recently added to the USGS list, Chile and Mexico were the leading import sources respectively.

Earlier in February, the Trump administration announced plans to invest nearly $12 billion to form a strategic reserve of rare earth minerals, in hopes of protecting domestic manufacturers from supply chain disruptions and reducing the country’s reliance on China.

The White House has also announced plans to invest directly in domestic and foreign producers of critical materials, including through the U.S. International Development Finance Corp., a U.S. government agency, which has vowed to take on projects normally considered too risky for the U.S. government.