In April of this year, the Trump Administration announced sweeping new tariffs, including a baseline 10% level on most U.S. imports, along with higher reciprocal rates for select countries. The World Trade Organization responded with a forecast of a 0.2% drop in global merchandise trade volume for 2025, warning that escalating trade tensions could drive the decline to as much as 1.5%. And in June, President Trump announced that steel and aluminum tariffs would double, from 25% to 50%.

Tariffs aren’t abstract line items; they’re direct shocks to the operating systems of global enterprises. From consumer goods and healthcare to heavy industry and retail, companies that carefully structured their supply chains, pricing and promotional strategies are now facing unanticipated costs and complexity. Decision-makers are moving quickly, setting up war rooms to assess impacts on product lines, customer segments and profitability.

Today’s top executives are locked in on new questions: How long will tariffs last? Who ultimately absorbs these costs — suppliers, producers or end consumers? Which categories face the steepest risks, and how can pricing or promotions be recalibrated without driving customers away? Should businesses consider reshoring manufacturing, or pivoting to alternative sourcing geographies?

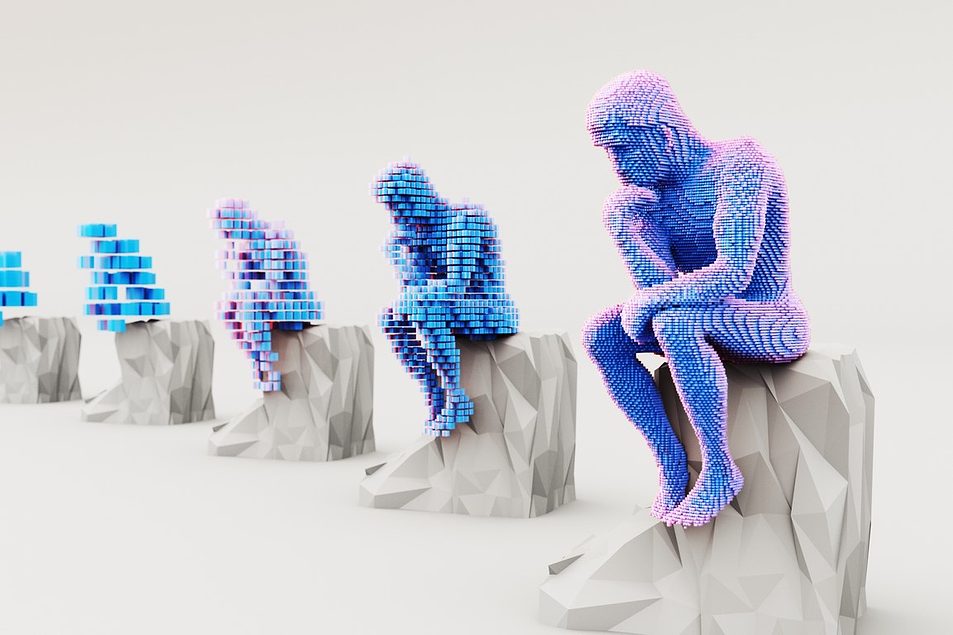

Most importantly: How can enterprises harness artificial intelligence and machine learning to navigate these decisions more rapidly, turning volatility into competitive advantage?

One truth stands out: Waiting it out is a losing strategy. Tariffs may evolve through negotiations, but they’re unlikely to vanish. That reality is pushing forward-looking companies to build aggressive, data-driven playbooks that cut across traditional silos. Instead of procurement solving for costs, marketing tweaking promos, and finance adjusting forecasts independently, the most resilient responses today are end-to-end — synchronizing sourcing, pricing, assortment and customer engagement in one ecosystem.

This hybrid of rapid-response and long-horizon planning is helping companies blunt short-term shocks while positioning for long-term growth.

Tariffs don’t hit all categories or geographies equally. The apparel sector faces a punishing 17% surge in costs under new regimes, while produce sees around 4%, and pharmaceuticals often glide by untouched. This uneven impact demands that leaders map vulnerabilities with surgical precision — by product line, country and customer segment.

Meanwhile, consumer behaviors are in flux. Shoppers are accelerating purchases on big-ticket items like cars and electronics, pulling demand forward and complicating inventory bets. In March alone, retail sales jumped 1.4%, with auto manufacturing receipts soaring 5.3%.

The bigger dilemma is the question of who pays. Consumers are weary of inflation. Blanket price hikes risk backlash; heavy-handed promotions can erode margins and train customers to wait for deals. Companies that can surgically optimize pricing and promotions are best positioned to maintain both market share and profitability.

In this environment AI has become mission-critical. It turns what was once gut feel or endless spreadsheet tinkering into precise, adaptive strategies. Leaders can now model price elasticity at the SKU, store and customer cohort levels; simulate how tariff-induced price shifts will impact demand, and pinpoint exactly where modest increases will do the least damage.

AI doesn’t stop at pricing. Advanced assortment engines recalibrate product mixes based on new demand signals, favoring private labels or smaller packs to keep prices sharp. Machine learning decodes which types of promotions truly drive an incremental lift, versus those that merely burn cash.

“What-if” scenario modeling is becoming the chief financial officer’s new weapon. Should the business absorb part of the cost? Test different mixes of promotions and impose selective increases? The right models deliver concrete, data-backed options instead of guesswork.

Beyond price tags, the supply chain is ground zero for tariff pain. Companies are recalculating everything, shifting suppliers, moving production, even eyeing reshoring. AI-powered simulations weigh landed costs across thousands of scenarios, factoring tariffs, transport and geopolitical risk to chart the most resilient paths.

There’s also a renewed push to renegotiate supplier terms, rethink Incoterms and share tariff burdens. Don’t think of these as stopgaps — they’re the strategic moves to future-proof operations against the next wave of global disruption.

Tariff turmoil not only poses threats; it cracks open opportunities. Competitors slow to adapt often leave pricing or assortment gaps ripe for exploitation. With AI-driven competitive benchmarking and assortment tools, nimble players can spot and fill these voids, gaining share while rivals are still reacting.

AI also helps pinpoint customer cohorts that are most at risk of defecting under price pressures. Proactive, personalized retention offers keep loyalty intact, even as market dynamics churn.

Tariffs are just the latest chapter in a world defined by shocks such as pandemics, raw-material crunches and geopolitical standoffs. Enterprises embedding AI-driven systems that self-learn, simulate and adapt in real time will thrive. They’ll use disruption to sharpen pricing, streamline sourcing, strengthen customer relationships and grow margins.

The real winners won’t be those that merely weather this tariff storm. They’ll be the ones that reacted to today’s turbulence to become leaner, faster and more intelligently aligned with customers and markets, no matter what comes next.

Majaz Mohammed is head of supply chain management with Tredence.